Whilst global credit seems stretched, Narrow Road continues to find great value opportunities for its clients and continues to deliver strong outperformance

Tech Wreck 2.0 and Debt Wreck 2.0 are Coming

In both equity and debt markets investors are buying securities that have identical characteristics to the disasters of the recent past.

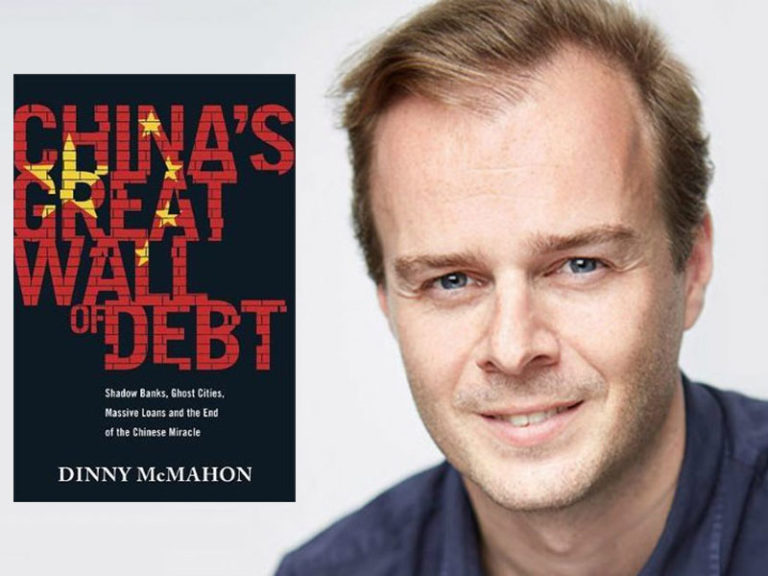

Reflections on Dinny McMahon’s Book on China’s Great Wall of Debt

Using a combination of hard data, analysis and anecdotes, Dinny McMahon lays out why China’s economy must eventually face up to its great wall of debt

Credit Snapshots – March 2019

Bite size updates on the RBA’s responsibility for bubbly house prices and Greece’s rating upgrade and bond issuance.

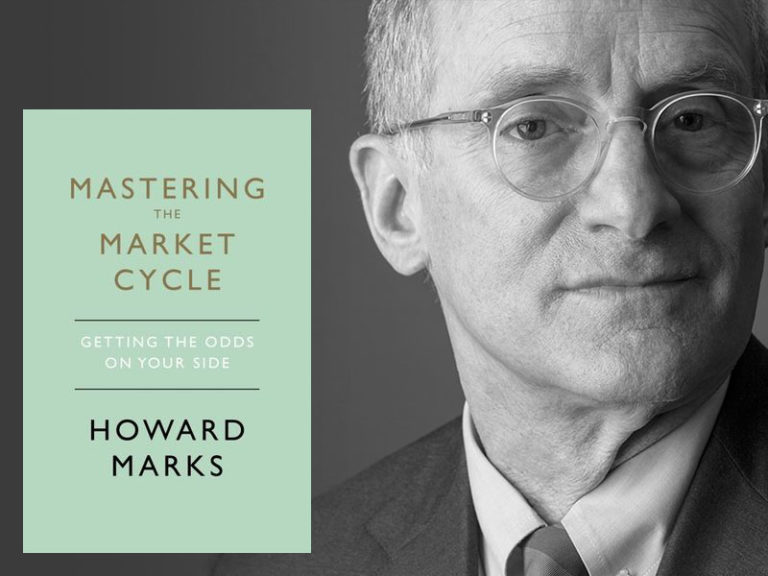

Reflections on Howard Marks’ Book on the Market Cycle

Howard Marks combines old and new material to explain how the market cycle works and how investors can take advantage of it.

Reflections on Ray Dalio’s Book on Big Debt Crises

Ray Dalio’s seminal book should be read by all investors and policy makers. However, following its policy prescriptions helps create the next debt crisis.

Time for ASIC to Fix its Longstanding Problems

The Royal Commission embarrassed ASIC with stinging criticism. Here’s some overdue actions they should take.

Why Bother Investing in Government Bonds?

Australian government bonds are very unlikely to reproduce the great returns of 2018. Here’s some low risk alternatives with a much better return outlook.

APRA Should Ignore the Big Banks on Tier 3 Capital

APRA has recommended Australian banks hold more tier 2 capital. This submission covers key measures aimed at reducing the risk of banks needing bailouts.

Is Australia Ready for the Next Financial Crisis?

Have governments and regulators acted to lessen the likelihood and severity of a potential downturn in Australia across the banking/financial system, monetary policy, fiscal policy, taxation policy and competition policy?

Narrow Road Capital’s Greatest Hits

Here’s my top 20 articles from the last 5 years; a mixture of credit commentary and policy pieces. The market ructions of 2018 have made my articles on Deutsche Bank, emerging market debt, cryptocurrencies, aggressive asset valuations and US high yield debt look pretty good.

Credit Snapshots – November 2018

Bite size updates on the Australian Business Securitisation Fund, securitisation downgrade risks, TLAC and Deutsche Bank