Lex Greensill, Softbank, credit insurers, fund managers and BaFin all played a part in billions being lost

Debt

In a Crisis, the Quality of Spending and Debt Matters

There is no free lunch, Keynesian responses do provide short term stimulus but place an anchor on future economic growth.

There’s Always Something Interesting Happening in Debt Markets

If you venture off the well trodden pathways, there’s always something interesting happening in debt markets.

A Chance to Reset in Debt

For those that seek out the illiquidity premium, this is a rare opportunity to increase your prospective return whilst decreasing the risk of long-term capital loss.

Tech Wreck 2.0 and Debt Wreck 2.0 are Coming

In both equity and debt markets investors are buying securities that have identical characteristics to the disasters of the recent past.

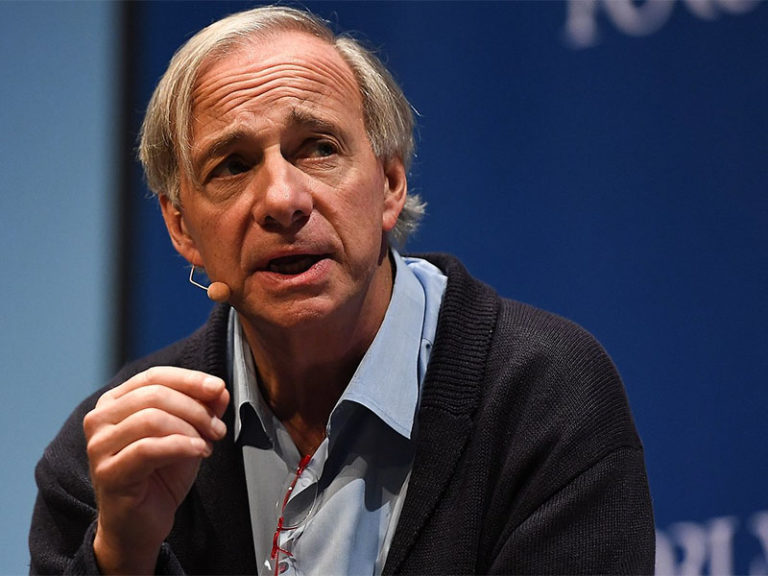

Reflections on Ray Dalio’s Book on Big Debt Crises

Ray Dalio’s seminal book should be read by all investors and policy makers. However, following its policy prescriptions helps create the next debt crisis.

Emerging Markets: Nothing New Under the Sun

The events overtaking Argentina and Turkey in recent months are textbook cases of an emerging market crisis. This article reviews the build-up, the break-down, the responses and who else is at risk.

The Dirty Dozen Sectors of Global Debt

This article details twelve global debt sectors where there’s lax credit standards and increasing risk levels, pointing to global credit being late cycle with limited upside left beyond carry.

BIS Nails the State of Global Corporate Debt

The Bank for International Settlements (BIS) quarterly report is always worth the read. Whilst it is academic in style and length, it consistently raises material that matters. Taken from the September report, the graphic below highlights the big issues for global corporate debt. The rest of this short article explains each component and its importance.

Emerging Market Debt: Dumb, Dumber and Dumbest

One of the classic signs that the credit cycle is nearing the end is that borrowers that shouldn’t be getting financed not only get funded, but get it at terms that seem crazy.

Sovereign Debt: the (Relatively) Good, the Bad and the Ugly

Using Australia, Italy and Greece as case studies, this article looks at the frequently ignored problems building in sovereign debt.

Meredith Whitney was Right – Just way too Early

Meredith Whitney’s prediction about US state and local governments defaulting is coming true – are subprime governments the next threat?