The MMT experiment is just a sugar hit, we need productivity reforms to promote sustainable prosperity

The Crown hybrid conundrum and hybrid misconceptions

With Blackstone and Oaktree showing interest there’s a wide range of possible outcomes on the Crown hybrids

Who’s to Blame for the Greensill Mess?

Lex Greensill, Softbank, credit insurers, fund managers and BaFin all played a part in billions being lost

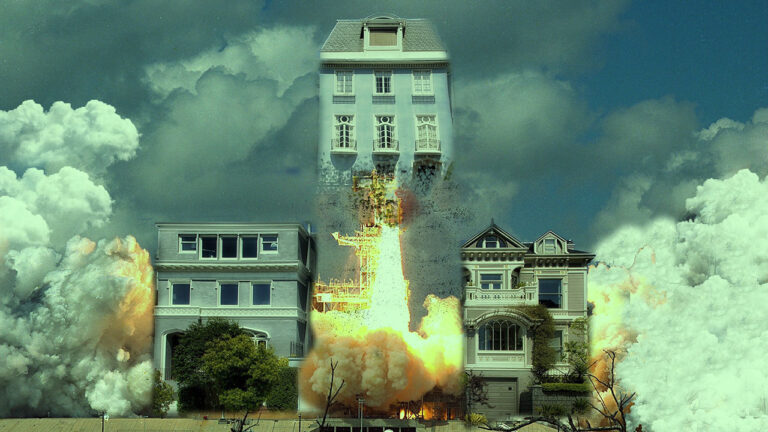

RBA to APRA – we’ve set house prices on fire, you fix it

The RBA admits that rising house prices are creating financial stability issues, but it expects APRA to clean up its mess

Credit lessons from the Greensill downfall

For credit veterans Greensill’s downfall isn’t a surprise with many common red flags long associated with this business

It’s (almost) all about the yield

If central banks take away the metaphorical punch bowl, the party would quickly become a riot with asset prices trashed

Neoliberalism is greatly misunderstood

Neoliberalism has lost the marketing battle, but the evidence points to its key tenets producing the best outcome for both rich and poor members of society.

MMT’s key claim is true but simplistic

MMT’s claim that governments can print money is true, but there’s substantial negative consequences which are neither immediate nor blatantly evident to the untrained observer

Too much cash can create a crisis

Financial markets are delirious with stimulus and won’t stop partying until there’s a crash so big that central banks can’t effect a bail out

More cracks are appearing in Chinese credit

The misplaced confidence of Chinese credit investors has been shaken by the default of three state owned entities including one rated “AAA”

What’s the endgame for government and central bank stimulus?

Governments and central banks have embarked on a journey with no clear idea of where they are going, here’s five ways it could end

Welcome to the zombie global economy

The number of zombie companies is growing and current policy settings point to this trend worsening in the years ahead