This article discusses why credit investors should consider the potential volatility of the companies they lend to with examples provided of good and bad risks

Four Dangerous High Yield Credit Myths

This article debunks four common high yield credit myths and explains the actual triggers and warnings signs of a downturn in credit markets

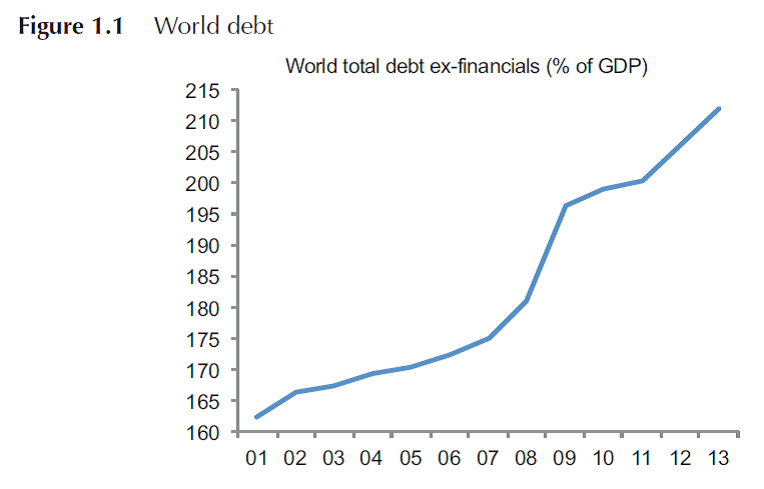

Is a Debt Bonfire Building? (Issues with the Quality and Quantity of Debt Outstanding)

This article summarises three major pieces of research that highlight potential issues with the quality and quantity of debt outstanding, and the implications for investors.

Are Bonds Liquid?

This article examines proposals to improve the liquidity of bonds and explores why liquidity is important to many investors and fund managers.

The Beginner’s Guide to Peer to Peer Lending

This article covers the development of P2P lending, its future prospects and recommendations on how potential lenders should analyse loan risks.

Second Round Submission to the Financial System Inquiry

This submission primarily covers bank capital and supervision but also looks at RMBS, small business credit, insolvency, superannuation, financial advice, regulators and credit cards.

The Great Fee Debate – Resetting Manager and Investor Expectations

This paper highlights some of the unrealistic expectations that managers and investors have in the ongoing debate over fees, with changes recommended for both sides.

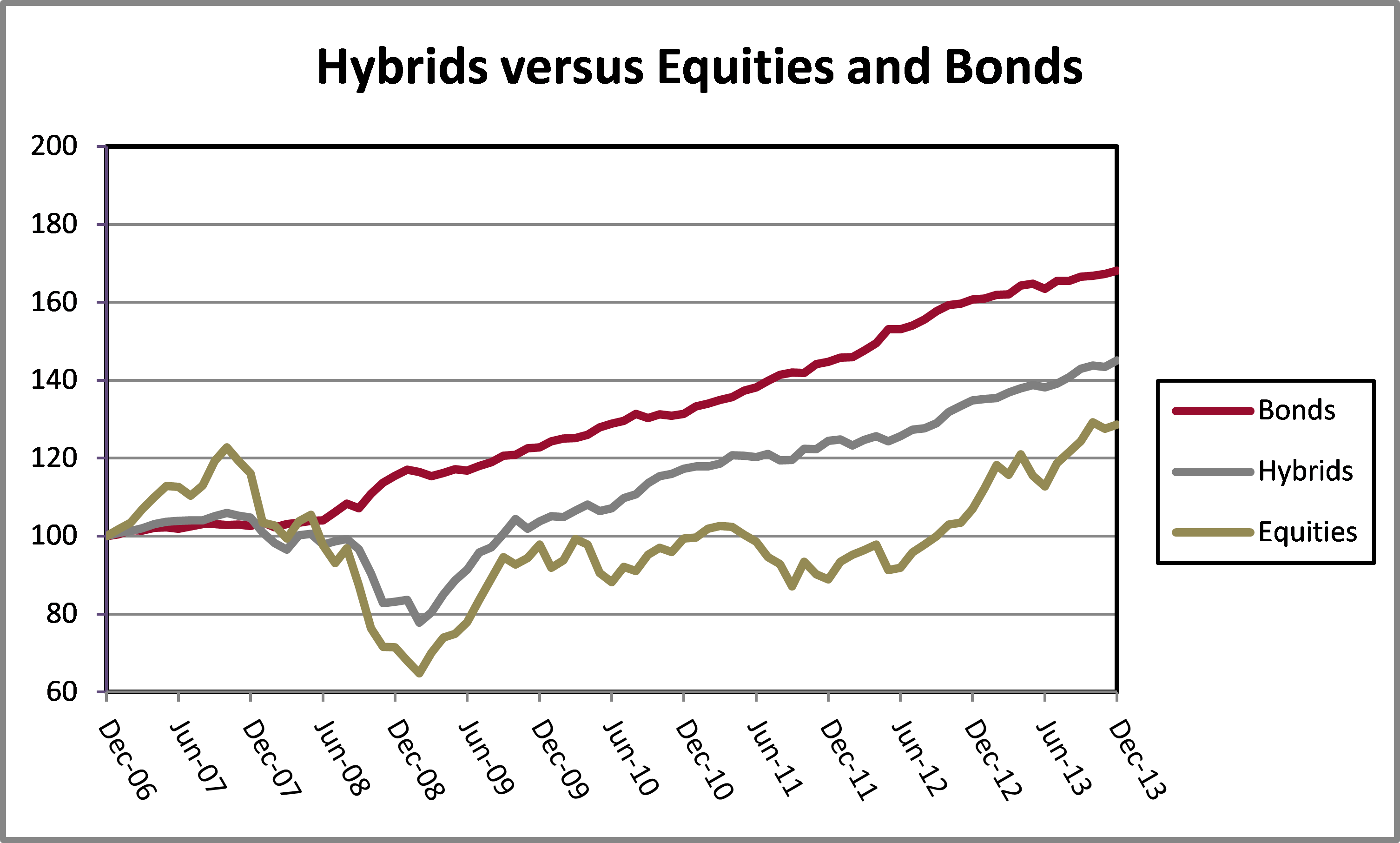

The Perils of Preference Shares

This paper analyses the weaknesses of preference shares, using recent Australian examples to illustrate the issues.

Taking the Heat Out of Home Lending

This article details specific measures banks should take beyond current prudential guidelines to de-risk their home lending operations in advance of a potential fall in house prices.

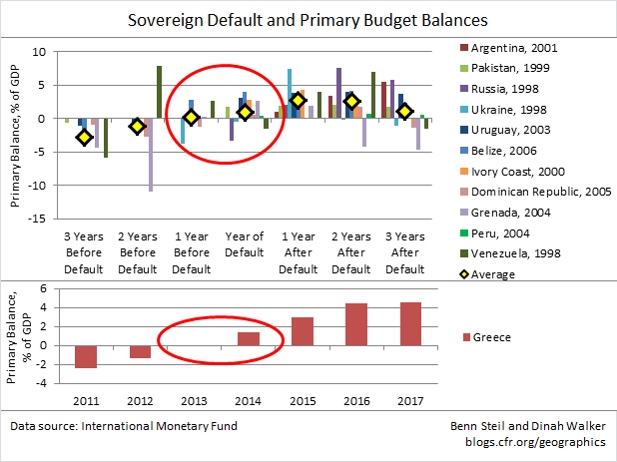

Beware of Greeks Selling Bonds? (A 5 C’s Analysis of Greek Debt)

This article uses the 5 C’s of credit to analyse the creditworthiness of Greece and to provide an opinion on the recently issued bonds.

Should Qantas be Given Taxpayer Assistance and What Will it Cost?

This article analyses whether taxpayer assistance for Qantas is fair and necessary. It also estimates the cost of a government guarantee of Qantas debts.

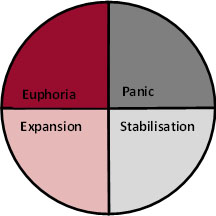

Where are we at in the credit cycle and how should investors respond?

This article defines the four phases of the credit cycle, then details how investors should position credit portfolios to profit from coming phases.